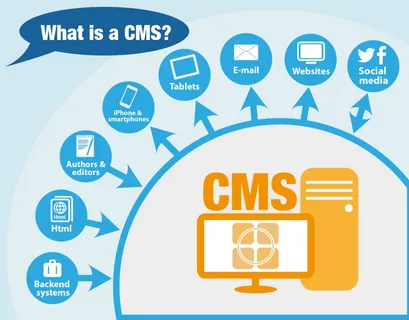

The report focuses on the relative performance of the CMS Cash Index™, which tracks the circulation of cash through ATM channels and the collection of cash from retail channels, both managed by CMS Info Systems. It is benchmarked against the S&P Global India Composite PMI (S&PGIPMI), a measure of economic activity expansion and contraction. The strong correlation between the two indices establishes the CMS Cash Index as a significant indicator of cash vibrancy in the country.

As a leader in the industry, CMS utilizes key data points to showcase the annual growth of pan-India ATM cash replenishments carried out by the company in metropolitan cities compared to semi-urban and rural areas during FY 2023. The report’s in-depth analysis illustrates the robust demand for cash-based transactions in India, covering patterns of ATM cash withdrawals across metropolitan, semi-metropolitan, semi-urban, and rural centers, as well as sector-level analysis of business activity using retail cash management data.

Anush Raghavan, President of Cash Management Services at CMS Info Systems, emphasized the report’s demonstration of the relevance and importance of cash in the Indian economy. Raghavan highlighted the need to expand financial inclusion and provide a convenient and low-cost payment system accessible to all segments of society. He also mentioned that CMS experienced a 10.1% growth in monthly average cash replenishment at ATMs and a strong 1.3X increase in average cash collection per point with e-commerce companies in FY23.

Key highlights from the CMS India Cash Vibrancy Report 2023 include:

- India witnessed the third-highest annual growth of 7.9% in Currency in Circulation (CIC) at $421 billion in 2021, with the UK (+11.8%) and China (+10.2%) leading in annual growth over 2020.

- India’s CIC to GDP ratio, after reaching 8.7% in 2016, has averaged around 12.4%, surpassing the 10-year average of 11.8%.

- Pan-India ATM cash replenishments by CMS Info Systems experienced a yearly growth of 16.6% in FY 2023.

- In March 2023, ATM cash withdrawals amounted to Rs 2.84 lakh crore, representing a remarkable absolute growth of 235.0% in just 76 months since demonetization.

- Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Uttar Pradesh collectively accounted for 43.1% of the total ATM cash replenished by CMS Info Systems in FY 2023. These states also had the highest gross state domestic product (GSDP) in FY 2022 according to MoSPI.

- Karnataka had the highest annual average cash replenishment per ATM at Rs 1.73 crore in FY 2023, an 18.1% increase compared to FY 2022.

- Chhattisgarh experienced the second-highest cash replenishment of Rs 1.58 crore in FY 2023, a slight decline of 2.1% from FY 2022.

- India witnessed peak cash usage and demand during the festive and wedding seasons from October to December in FY 2022 and in October, December, and March of FY 2023. Sector-wise analysis of average cash collected from Retail Cash Management (RCM) points revealed a balanced performance across six key industry sectors. Transportation, Organised Retail, and Banking & Financial services (BFSI) sectors experienced annual growth rates of 38.7%, 14.4%, and 5.6% respectively during FY 2023.

- The opening of the economy following the COVID-19 pandemic is evident in the Transportation sector, with average cash collection per RCM point increasing 1.4 times from Rs 1.49 crore in FY 2022 to Rs 2.06 crore in FY 2023.

Anush Raghavan also emphasized that a significant portion of India’s population remains unbanked, relying on cash for their daily transactions due to limited access to formal banking services. He further mentioned that the lack of financial and digital literacy raises security concerns for digital payments, despite their convenience. Raghavan believes that striking the right balance between cash and digital transactions will propel India’s booming economy towards further growth.

The CMS India Cash Vibrancy Report 2023 provides insights into cash usage and utility at global, national, state, and tier levels. By highlighting the performance of the CMS Cash Index™ and the S&P Global India Composite PMI, the report offers a comprehensive assessment of cash vibrancy, closely mirroring each other except during unusual macroeconomic events.